PayWay Net

PayWay is a simple, secure, internet-based solution to collect and manage customer payments.

About PayWay Net

This page describes PayWay Net.

PayWay Net allows you to accept once-off online payments.

You can use PayWay Net for:

- online sales

- donations

- invoice, statement or bill payments

- stored value top-up.

Benefits

- Customer service - online payments by card or PayTo are quick and easy for your customers

- Ease of integration - simply link to a payment page hosted by us, or build seamless integration with PayWay Trusted Frames

- Reduce compliance scope - outsource processing of cards to reduce your PCI-DSS compliance scope.

How it works

PayWay Net is available as either a hosted payment page or trusted frame.

| Hosted payment page | Trusted frame |

|---|---|

| Payment pages hosted by us | Embed PayWay trusted frame into your payment page |

| Accept cards, PayPal® and PayTo | Accept cards |

| Setup using online wizard | Integrate using Javascript and REST API |

| Customise with your logo and customer reference number label | Maintain full control over customer experience and branding |

| Receive an email when each payment is processed | Receive a real-time response back to your server |

| Protect yourself with Fraud Guard and 3D secure | Protect yourself with Fraud Guard |

PayWay Net also allows for your shopping cart details to be securely displayed on a payment page hosted by us. This integration type has been replaced by the trusted frame solution.

Other APIs

PayWay supports other ways to interface with your software:

| Other APIs | Features |

|---|---|

| PayWay REST API | As well as the PayWay Net Trusted Frame, use the PayWay REST API to:

See PayWay REST API |

| PayWay Credit Card API | Process payments by sending card details from your PCI-DSS compliant system. |

Hosted payment page

- Accept credit card and PayPal® payments on a page hosted by us

- Protect yourself from fraud using 3D Secure

- Customise with your logo and customer reference number label

- Receive an email when each payment is processed.

No website development is required, but you may wish to add a link from your website to PayWay.

Contact us to purchase PayWay Net. You must apply for a merchant facility in order to process credit card payments.

To setup PayWay Net:

- Sign in to PayWay

- Click Settings

- Click Company Details

- Set your contact details, social media sites and upload a logo

- Click Settings

- Click PayWay Net

- Choose No Website or Simple Link and follow the wizard.

Make a note of your Biller Code.

You can customise:

- Your company logo

- Name of reference number you collect (e.g. customer number, invoice number)

- Rules for your customer reference number

- Minimum and maximum payment amounts

- Credit card surcharges.

To accept PayPal:

- Sign in to PayWay

- Click Settings

- Click PayPal Accounts

- Follow the wizard to link your PayPal® Business or Premier account to PayWay.

No website

If you do not have a website, once you have set up PayWay Net, tell your customers to:

- Visit the PayWay website

- Click Make a payment

- Enter your biller code and follow the prompts.

Your customers will enter a reference number so you know who paid.

Westpac customers

The PayWay website URL is www.payway.com.auSt. George customers

The PayWay website URL is payway.stgeorge.com.auSimple link

To link to PayWay from a website you are building in HTML, copy and paste the example HTML link into the <body>.

Westpac link

<a href="https://www.payway.com.au/MakePayment?BillerCode=??????">Pay</a>St. George link

<a href="https://payway.stgeorge.com.au/MakePayment?BillerCode=??????">Pay</a>To link to PayWay from a website created with a content management system, add a link to this URL:

Westpac link

https://www.payway.com.au/MakePayment?BillerCode=??????St. George link

https://payway.stgeorge.com.au/MakePayment?BillerCode=??????Replace ?????? with your biller code from the Hosted Payment Page wizard.

To pass additional information to PayWay, you can add query string parameters to the URL.

This is useful if you want to:

- pass details specific to the payment (reference, amount and customer email address)

- accept payments for different reasons (e.g. fees, donations, events).

Settlement parameters

To choose which merchant or PayPal® facility to use, use these parameters:

| Parameter | Notes |

|---|---|

| merchant_id | Choose which of your linked merchant facilities to use for this payment. |

| paypal_email | Choose which of your linked PayPal® accounts to use for this payment. |

| payto_payee_account_id | Specify you linked PayTo accounts to use for this payment. |

Customer email

To pass the customer's email address to PayWay, use this parameter:

| Parameter | Notes |

|---|---|

| receipt_address | Customer's email address for receipt emails |

Payment reference parameters

The Payment Reference is used so that you know who has paid. This appears as 'Customer Reference Number' on PayWay transaction reports and the transaction search page. You may wish to use a customer number, membership number or invoice number.

To pass the payment reference to PayWay, use these parameters:

| Parameter | Notes |

|---|---|

| payment_reference | Your reference for this payment. |

| payment_reference_required | false if you do not want your customer to enter a reference number. |

| payment_reference_change | true if you are passing payment_reference and want your customer to edit this value |

To change the payment reference field name and validation rules, use these parameters:

| Parameter | Notes |

|---|---|

| payment_reference_text | The label to the left of the payment reference field |

| payment_reference_text_help | The message to the right of the payment reference field |

| payment_reference_minimum_length | The minimum length allowed for the payment reference |

| payment_reference_maximum_length | The maximum length allowed for the payment reference (at most 100) |

| payment_reference_check_digit_algorithm | See list of supported algorithms below |

| Check Digit Algorithms |

|---|

MOD10V01 for the Luhn algorithm |

MOD10V05 |

MOD10V08 |

MOD10V17 |

Payment amount parameters

To pass the payment amount to PayWay, use these parameters:

| Parameter | Notes |

|---|---|

| payment_amount | Amount of the payment before any surcharge is added by PayWay |

| payment_amount_change | true if you are passing the payment_amount and want your customer to edit this value |

To change the payment amount field name and validation rules, use these parameters:

| Parameter | Notes |

|---|---|

| payment_amount_text | The label to the left of the payment amount |

| payment_amount_text_help | The message to the right of the payment amount |

| payment_amount_minimum | The minimum payment amount you accept |

| payment_amount_maximum | The maximum payment amount you accept |

This is useful if you accept payments for a variety of purposes e.g. both events and donations.

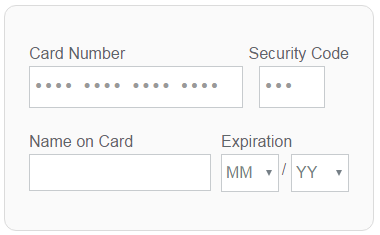

Trusted frame

The PayWay Trusted Frame solution allows you to:

- Embed a PayWay trusted iframe in your payment page

- Accept payments by credit card

- Maintain full control over the user experience

- Reduce your PCI-DSS compliance scope

- Protect yourself with Fraud Guard

- Integrate using Javascript and REST API.

The trusted frame is part of the PayWay REST API.

For step-by-step instructions, see Trusted Frame Tutorial.

Shopping cart plugins

We have developed shopping cart plugins for:

- Magento

- osCommerce

- PestraShop

- UberCart

- VirtueMart

- ZenCart.

Westpac customers

Download PayWay Shopping Card Plugins for Westpac PayWay Net.St. George customers

Download PayWay Shopping Card Plugins for St. George PayWay Net.Many other plugins have been developed by shopping cart providers.

If you are developing a new plugin, use the Trusted Frame.

Reference

Test card numbers

Use the following credit card numbers with your test facility. All other card numbers will return 42 No universal account. An incorrect expiry date will return 54 Expired card.

The cardholder name does not matter.

| Card Number | Security Code | Expiry | Response |

|---|---|---|---|

| 4564710000000004 | 847 | 02/29 | 08 Visa Credit Approved |

| 4564030000000007 | 847 | 02/30 | 08 Visa Debit Approved |

| 5163200000000008 | 070 | 08/30 | 08 Mastercard Credit Approved |

| 5163610000000008 | 847 | 02/30 | 08 Mastercard Debit Approved |

| 2221000000000009 | 009 | 01/30 | 08 Mastercard Approved |

| 6226880000000000 | 453 | 11/25 | 08 UnionPay Approved |

| 6226880000000018 | 453 | 11/25 | 05 UnionPay Declined |

| 4564710000000012 | 963 | 02/25 | 54 Visa Expired |

| 4564710000000020 | 234 | 05/30 | 51 Visa Low Funds ($10 credit limit) |

| 5163200000000016 | 728 | 12/29 | 04 Mastercard Stolen |

| 4564710000000046 | 123 | 06/25 | 08 Visa High Funds ($99,999,999.99 credit limit) |

| 5163200000000040 | 321 | 09/25 | 08 MasterCard High Funds ($99,999,999.99 credit limit) |

| 376000000000006 | 2349 | 06/30 | 08 American Express Approved |

| 343400000000016 | 9023 | 01/29 | 62 American Express Declined |

| 36430000000007 | 348 | 06/32 | 08 Diners Club Approved |

| 36430000000015 | 988 | 08/31 | 43 Diners Club Stolen |

| 3530000000000003 | 573 | 10/25 | 00 JCB Approved |

| 3530000000000011 | 573 | 10/25 | 05 JCB Declined |

Contact us

For sales, help and technical support contact us.